North America Construction Market Update Report

Infrastructure & Residential sectors remain upbeat in uncertain times

We came out of the initial Covid-19 lockdown towards the end of June and the market started to slowly return across the various construction sectors. Although a lot of industries saw layoffs, the construction industry still had a pulse and many professionals were furloughed rather than permanently let go, and where possible, many were able to continue working remotely.

It is a tale of 3 sectors: ICI – Residential – Infrastructure

The ICI sector looks to have been impacted the most. Retail, office, hospitality, and sports complexes have been hardest hit during the lockdown, and still to this day continue to see a reduction in foot traffic and usage due to a second wave of Covid-19. Many people were forced to work remotely and some of these changes have now become a permanent situation. This may impact the demand for commercial office space and is likely to have a domino effect reducing office developments. There is likely to be less short-term investment, with the medium to long term still largely unknown. Projects that were underway are still progressing but there could be a pullback in developing new projects of these type and lenders less likely to support new developments across retail, office, hospitality, and sports complexes.

The Residential sector in general has experienced a much faster comeback, especially during Q3. This has been driven by a couple of key factors, namely a lack of supply and high demand, plus the low interest rates and borrowing costs currently on offer due to the pandemic. The September report from the Toronto Regional Real Estate Board (TRREB) shows a strong month, with a return to exceptionally high numbers for home sales and listings. Six months after the onset of the pandemic, the residential sector is in a much better place than the ICI sector, but the question is will it continue into Q4 and early 2021? During the lockdown in Q2, planning and building applications slowed or were held up, stalling developments. Although there is a current surge in workload to deliver existing projects that were delayed over the past three to six months, there is still a level of uncertainty about how the ongoing pandemic may affect future development into 2021.

The Infrastructure sector is going to benefit the most from the pandemic recession with the Federal Government and some Provincial Governments already indicating their intention to spend big in this area. Investment in new infrastructure, such as schools, hospitals, roads, subways, digital networks, agriculture, and energy will create jobs and speed up an economic recovery. Spending on new capital projects also tends to attract more private investment. Consider a new subway stop that is built on the outskirts of the GTA that was once so far out that it was an inconvenience to travel into the city by vehicle. These new locations, now easily accessible by train, will experience a boost in economic activity due to an increase in population and as a result, new residential and commercial development will be stimulated.

Rider Levett Bucknall’s North American Cost Report for Q3 stated:“ The Toronto construction market remains quite busy, driven by a very strong high-rise residential sector and government spending on infrastructure especially transit projects. Although there was a slowdown in the spring and early summer due to the COVID-19 pandemic, the market has recovered” and “Despite a significant drop in immigration to Canada, residential sales remain strong indicating a busy year in 2021. As working remotely becomes more of a permanent arrangement for many workers, we expect to see a downturn in office development and other commercial construction projects”.

Market forecast

In the wake of Covid-19 it’s hard to make a solid prediction since no one in our lifetime has experienced a pandemic like this. The construction industry faces a number of challenges such as social distancing measures, less workers on site, delays in receiving building materials, project delays, shutdowns, and PPE shortages. This has had a severe impact on productivity, extended project schedules and profit margins.

For the next six to twelve months, there is a more positive outlook for both the infrastructure and residential sectors but things will more than likely remain relatively flat for new ICI construction projects. As more rollback measures are introduced by the Provincial Government to slow down the spread of Covid-19, there could be a lack of confidence in bringing new developments online.

A focus on the infrastructure sector, where both the Provincial and Federal Government will be looking to prop up the economy through stimulus spending, will hopefully promote private investment. This stimulus is already happening with recent announcements from both the Provincial and Federal Governments.

If the confidence in the market returns, we expect to see strong competition for design, cost, and construction talent across both the Residential and Infrastructure sector’s over the next 12 months. We also expect a tight squeeze on field and project management candidates of all levels, as projects come online.

Although many organizations will aim to reduce their spend on external recruitment as the pandemic continues, there is still an opportunity to see value in using a recruitment firm. There is a definite hesitancy when talking to candidate’s about making a move during current times. This will translate into a reduction of active and passive candidates on the market. When time runs out on much needed hires, clients will look to utilize recruitment firms as a support function for their internal talent acquisition teams, and there is likely to be increased urgency for new hires. This is where partnering with a recruitment firm with a strong head-hunting strategy, and strong candidate relationships and networks will benefit businesses. Businesses who have exclusive partnership with recruitment firms will benefit from a fully resourced recruitment team committed to finding the best talent for their projects and teams.

Recruitment highlights

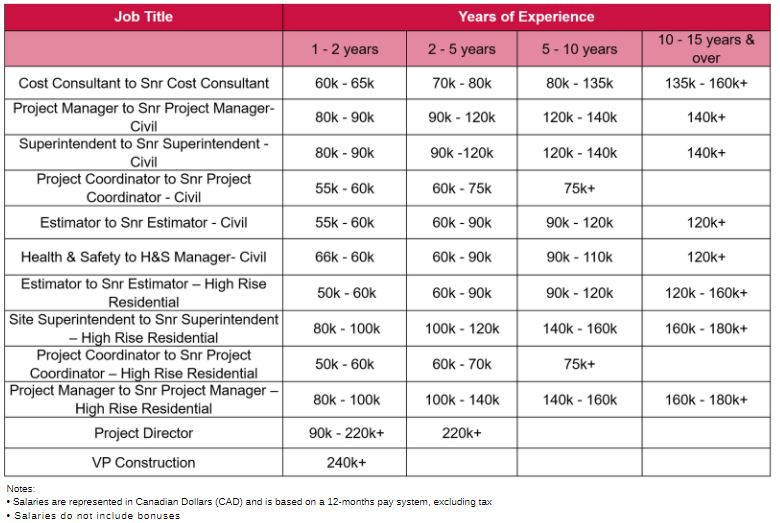

Salaries expected to rebound

During Q3 and Q4, and even into Q1 of 2021, the Federal Government is supporting the payment of salaries through various initiatives like CERB (in the midst of a change of structure and name similar to EI) and CEWS, which resulted in many companies being able to stay afloat amidst a reduction in revenue during the pandemic. Even with this ongoing wage support, which is set to remain until summer 2021, many organisations have decided to implement pay cuts for salaried staff in order to retain their talent. The idea was that pay cuts would allow them to retain staff for longer before having to let them go. This could be seen as a shrewd move, since there is still a shortage of talent across the construction industry, and when the end of the pandemic is in sight, and all construction sector’s rebound, there will be fierce competition for talent that will likely see a return to above market salaries.

© Archer Recruitment. All Rights Reserved.